Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

Discover how Palo Alto Networks creates lasting value through platform strategy, AI innovation, and competitive moats in cybersecurity.

In an era where cyber threats evolve faster than most companies can adapt, one organization has positioned itself not just as a defender, but as the architect of an entire digital fortress. Palo Alto Networks, with its $102 billion market capitalization, isn’t merely selling cybersecurity products—it’s building an unassailable platform empire that customers find increasingly difficult to escape and competitors struggle to replicate.

The investment story of Palo Alto Networks (PANW) transcends quarterly earnings and revenue growth rates. It’s a narrative about strategic vision, platform consolidation, and the rare ability to transform from a hardware vendor into a software-driven, AI-powered cybersecurity ecosystem. While the numbers tell one story, the qualitative factors—leadership excellence, competitive moats, and market positioning—reveal why this company may be constructing one of the most defensible business models in technology.

This isn’t just another cybersecurity stock analysis. It’s an exploration of how visionary leadership, strategic platformization, and relentless innovation create lasting competitive advantages that don’t always appear on balance sheets but determine long-term shareholder value.

When Nikesh Arora took the helm as Chairman and CEO of Palo Alto Networks in June 2018, he brought more than just impressive credentials from Google and SoftBank—he brought a platform-first mindset that would fundamentally reshape the cybersecurity landscape. With a net worth estimated at $1.5 billion, Arora isn’t just managing a company; he’s building a legacy.

Arora’s leadership philosophy centers on empowering teams to think creatively, take calculated risks, and embrace change as a catalyst for growth. His hands-on approach actively engages with employees, customers, and stakeholders to foster collaboration and drive results. This isn’t corporate speak—it’s the foundation of a cultural transformation that has enabled Palo Alto Networks to execute one of the most ambitious platform strategies in enterprise software.

The CEO’s background is particularly telling. Over his six-year tenure at Palo Alto Networks, Arora has expanded and reorganized the organization, including safely incorporating generative AI into all of its products. This isn’t incremental improvement; it’s architectural reinvention. Where other cybersecurity leaders talk about AI integration, Arora has systematically embedded it across the entire platform ecosystem.

Arora’s vision extends beyond traditional cybersecurity boundaries. The company’s 2025 predictions reveal a perspective on the convergence of cybersecurity and AI, encompassing emerging threats and opportunities that most competitors haven’t even recognized. This forward-looking approach isn’t just about staying ahead of threats—it’s about defining the future battleground and ensuring Palo Alto Networks controls the high ground.

The leadership team’s stability and experience create a multiplier effect. Unlike companies suffering from executive churn, Palo Alto Networks has maintained strategic continuity while adapting tactically to market changes. This stability allows for long-term planning and execution that competitors struggling with leadership transitions cannot match.

The platformization strategy is not only driving ARR growth and retention but also redefining the cybersecurity landscape, with analysts setting a $15 billion ARR target for 2030. But what makes this platform approach so defensible?

Traditional cybersecurity companies sell point solutions—individual products that solve specific problems. Palo Alto Networks has orchestrated something far more sophisticated: an integrated ecosystem where each component becomes more valuable when combined with others. This creates what economists call “network effects” and what investors should recognize as an expanding economic moat.

The effort includes deferred billings and other incentives designed to encourage organizations to consolidate spend on Palo Alto Networks cybersecurity platforms, as the cybersecurity industry embarks into its next phase where the market will continue to converge towards fewer, more comprehensive solutions.

Once an organization embeds Palo Alto Networks’ platform into their security operations, the switching costs become astronomical. It’s not just about migrating data or retraining staff—it’s about reconstructing an entire security architecture. The platform creates operational dependencies that make competitive displacement increasingly difficult as customer tenure increases.

This dynamic is particularly powerful in cybersecurity, where the cost of switching mistakes can be catastrophic. Chief Information Security Officers (CISOs) don’t experiment with unproven alternatives when their current platform is working. The risk-reward calculation heavily favors incumbent platforms with proven track records.

Palo Alto Networks’ acquisition of Protect AI represents a decisive, platform-level play to shape the nascent AI/ML security market while it’s still early. This isn’t just another acquisition—it’s strategic positioning for the next phase of cybersecurity evolution.

The company’s AI integration creates a self-reinforcing advantage. More data from more customers improves threat detection across the entire platform. Better detection attracts more customers, generating more data, creating a virtuous cycle that competitors cannot easily replicate. This is the kind of sustainable competitive advantage that Warren Buffett calls an “economic moat.”

PANW’s 2024 R&D expense of 24% has remained constant, demonstrating the company’s commitment to sustained innovation without compromising operational efficiency. This consistent investment level signals management’s confidence in their ability to generate returns on research investments while maintaining competitive positioning.

The innovation culture at Palo Alto Networks differs fundamentally from typical enterprise software companies. Rather than developing isolated products, the company creates platform components that enhance the entire ecosystem’s value proposition. Each new capability doesn’t just serve a specific market segment—it strengthens the platform’s gravitational pull on existing customers and competitive positioning against rivals.

The company’s acquisition strategy reveals sophisticated strategic thinking. Rather than acquiring for revenue or customer base, Palo Alto Networks acquires for capabilities that extend platform functionality and market coverage. Each acquisition serves the larger platformization vision, creating synergies that exceed the sum of individual parts.

This approach contrasts sharply with competitors who acquire for scale or geographic expansion. Palo Alto Networks acquires for strategic depth, building capabilities that reinforce competitive moats rather than simply expanding market presence.

The cybersecurity industry’s evolution toward platform unity, data transparency, and strategic partnerships defines success in 2025. Palo Alto Networks isn’t just riding this trend—they’re creating it.

Enterprise customers increasingly prefer comprehensive platforms over point solutions for several compelling reasons: simplified vendor management, integrated threat intelligence, unified security policies, and reduced operational complexity. This consolidation trend strongly favors established platforms with broad capability sets and proven integration expertise.

In cybersecurity, brand reputation transcends traditional marketing metrics. When organizations experience security incidents, they need partners they can trust completely. Palo Alto Networks has built a brand synonymous with enterprise-grade security and reliability—intangible assets that command premium pricing and customer loyalty.

The company’s thought leadership in emerging areas like AI security and zero-trust architecture positions it as not just a vendor but a strategic advisor. This consultative relationship creates deeper customer engagement and higher switching costs than transactional vendor relationships.

For fiscal 2024, the company forecasted billings growth of 10% to 11%, revenue growth of 16%, and an impressive adjusted EPS increase of 25% to 26%. These numbers tell a story of operational leverage and platform scaling effects.

The revenue growth profile reflects successful platform expansion rather than simple market share capture. As customers adopt additional platform components, average contract values increase while marginal customer acquisition costs decrease. This dynamic creates accelerating returns to scale that pure-play security vendors cannot replicate.

The company’s margin expansion demonstrates genuine pricing power derived from platform switching costs and integrated value proposition. Unlike commodity software providers competing on price, Palo Alto Networks competes on comprehensive capabilities and operational integration—factors that justify premium pricing.

Strong cash flow generation enables the company to fund platform expansion and strategic acquisitions without diluting shareholders or constraining growth investments. This financial independence provides strategic flexibility that debt-burdened or cash-constrained competitors lack.

The cash generation profile also supports consistent R&D investment and aggressive market expansion without compromising profitability or shareholder returns. This balance of growth investment and profitability indicates mature management execution and sustainable business model dynamics.

For Palo Alto Networks to triple in value over the next decade, several strategic elements must align perfectly:

The platform consolidation trend must accelerate, with enterprises increasingly preferring comprehensive security ecosystems over point solutions. Early evidence suggests this trend is strengthening as organizations prioritize operational efficiency and integrated threat response capabilities.

AI integration must deliver measurable security improvements that justify premium pricing while creating competitive differentiation. The company’s early AI implementation across platform components positions it advantageously, but execution quality will determine whether this advantage expands or erodes.

The path to $15 billion ARR by 2030 requires consistent platform expansion and customer wallet share capture. Success demands not just retaining existing customers but systematically expanding their platform adoption and contract values.

The counter-narrative focuses on several strategic vulnerabilities:

Cloud-native security startups might develop fundamentally superior architectures that make current platform approaches obsolete. While Palo Alto Networks has cloud capabilities, innovative competitors might create solutions that are native to cloud environments from inception rather than adapted to them.

Large technology platforms like Microsoft, Amazon, or Google might bundle security capabilities into their core offerings at marginal pricing. This “good enough” security approach could commoditize portions of Palo Alto Networks’ value proposition, particularly for cost-sensitive market segments.

Regulatory changes might fragment the cybersecurity market in ways that favor specialized solutions over integrated platforms. Compliance requirements could create market segments where platform breadth becomes less valuable than specialized depth.

Economic downturns might pressure enterprises to prioritize cost reduction over platform consolidation, potentially slowing the secular shift toward comprehensive security ecosystems that drives the company’s growth thesis.

The qualitative investment thesis for Palo Alto Networks rests on three interconnected pillars: visionary leadership executing a platform strategy, structural competitive advantages that strengthen over time, and market positioning in a secular growth industry where the company helps define future competitive dynamics.

Nikesh Arora’s leadership combines strategic vision with operational excellence, creating a management team capable of navigating complex market transitions while building sustainable competitive advantages. The platformization strategy isn’t just a business model—it’s an architectural approach that creates expanding economic moats through network effects, switching costs, and operational dependencies.

The cybersecurity market’s evolution toward consolidation and platform solutions strongly favors established players with comprehensive capabilities and proven integration expertise. Palo Alto Networks isn’t just participating in this trend—it’s leading the transformation while building defensive moats that protect market position and pricing power.

The central question for long-term investors: Will platform economics and AI integration create an unassailable competitive position, or will architectural disruption and platform competition erode current advantages?

The qualitative evidence suggests platform advantages are strengthening while competitive threats remain manageable. Leadership quality, strategic positioning, and execution capabilities indicate this company is building something more durable than typical technology investments—a defensible platform empire in an indispensable market.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Past performance does not guarantee future results. Please consult with qualified financial professionals before making investment decisions. Cybersecurity investments carry inherent risks related to technology disruption, competitive pressure, and market volatility.

Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

AppLovin posted record Q2 2025 results, with 77% revenue growth, higher margins, and a strategic shift toward core adtech platforms.

Discover how the Big Beautiful Bill reshapes taxes, healthcare, and national spending in 2025. Explore its impacts on personal finances, federal debt, and everyday life in this comprehensive analysis.

Discover how Palo Alto Networks creates lasting value through platform strategy, AI innovation, and competitive moats in cybersecurity.

In an era where cyber threats evolve faster than most companies can adapt, one organization has positioned itself not just as a defender, but as the architect of an entire digital fortress. Palo Alto Networks, with its $102 billion market capitalization, isn’t merely selling cybersecurity products—it’s building an unassailable platform empire that customers find increasingly difficult to escape and competitors struggle to replicate.

The investment story of Palo Alto Networks (PANW) transcends quarterly earnings and revenue growth rates. It’s a narrative about strategic vision, platform consolidation, and the rare ability to transform from a hardware vendor into a software-driven, AI-powered cybersecurity ecosystem. While the numbers tell one story, the qualitative factors—leadership excellence, competitive moats, and market positioning—reveal why this company may be constructing one of the most defensible business models in technology.

This isn’t just another cybersecurity stock analysis. It’s an exploration of how visionary leadership, strategic platformization, and relentless innovation create lasting competitive advantages that don’t always appear on balance sheets but determine long-term shareholder value.

When Nikesh Arora took the helm as Chairman and CEO of Palo Alto Networks in June 2018, he brought more than just impressive credentials from Google and SoftBank—he brought a platform-first mindset that would fundamentally reshape the cybersecurity landscape. With a net worth estimated at $1.5 billion, Arora isn’t just managing a company; he’s building a legacy.

Arora’s leadership philosophy centers on empowering teams to think creatively, take calculated risks, and embrace change as a catalyst for growth. His hands-on approach actively engages with employees, customers, and stakeholders to foster collaboration and drive results. This isn’t corporate speak—it’s the foundation of a cultural transformation that has enabled Palo Alto Networks to execute one of the most ambitious platform strategies in enterprise software.

The CEO’s background is particularly telling. Over his six-year tenure at Palo Alto Networks, Arora has expanded and reorganized the organization, including safely incorporating generative AI into all of its products. This isn’t incremental improvement; it’s architectural reinvention. Where other cybersecurity leaders talk about AI integration, Arora has systematically embedded it across the entire platform ecosystem.

Arora’s vision extends beyond traditional cybersecurity boundaries. The company’s 2025 predictions reveal a perspective on the convergence of cybersecurity and AI, encompassing emerging threats and opportunities that most competitors haven’t even recognized. This forward-looking approach isn’t just about staying ahead of threats—it’s about defining the future battleground and ensuring Palo Alto Networks controls the high ground.

The leadership team’s stability and experience create a multiplier effect. Unlike companies suffering from executive churn, Palo Alto Networks has maintained strategic continuity while adapting tactically to market changes. This stability allows for long-term planning and execution that competitors struggling with leadership transitions cannot match.

The platformization strategy is not only driving ARR growth and retention but also redefining the cybersecurity landscape, with analysts setting a $15 billion ARR target for 2030. But what makes this platform approach so defensible?

Traditional cybersecurity companies sell point solutions—individual products that solve specific problems. Palo Alto Networks has orchestrated something far more sophisticated: an integrated ecosystem where each component becomes more valuable when combined with others. This creates what economists call “network effects” and what investors should recognize as an expanding economic moat.

The effort includes deferred billings and other incentives designed to encourage organizations to consolidate spend on Palo Alto Networks cybersecurity platforms, as the cybersecurity industry embarks into its next phase where the market will continue to converge towards fewer, more comprehensive solutions.

Once an organization embeds Palo Alto Networks’ platform into their security operations, the switching costs become astronomical. It’s not just about migrating data or retraining staff—it’s about reconstructing an entire security architecture. The platform creates operational dependencies that make competitive displacement increasingly difficult as customer tenure increases.

This dynamic is particularly powerful in cybersecurity, where the cost of switching mistakes can be catastrophic. Chief Information Security Officers (CISOs) don’t experiment with unproven alternatives when their current platform is working. The risk-reward calculation heavily favors incumbent platforms with proven track records.

Palo Alto Networks’ acquisition of Protect AI represents a decisive, platform-level play to shape the nascent AI/ML security market while it’s still early. This isn’t just another acquisition—it’s strategic positioning for the next phase of cybersecurity evolution.

The company’s AI integration creates a self-reinforcing advantage. More data from more customers improves threat detection across the entire platform. Better detection attracts more customers, generating more data, creating a virtuous cycle that competitors cannot easily replicate. This is the kind of sustainable competitive advantage that Warren Buffett calls an “economic moat.”

PANW’s 2024 R&D expense of 24% has remained constant, demonstrating the company’s commitment to sustained innovation without compromising operational efficiency. This consistent investment level signals management’s confidence in their ability to generate returns on research investments while maintaining competitive positioning.

The innovation culture at Palo Alto Networks differs fundamentally from typical enterprise software companies. Rather than developing isolated products, the company creates platform components that enhance the entire ecosystem’s value proposition. Each new capability doesn’t just serve a specific market segment—it strengthens the platform’s gravitational pull on existing customers and competitive positioning against rivals.

The company’s acquisition strategy reveals sophisticated strategic thinking. Rather than acquiring for revenue or customer base, Palo Alto Networks acquires for capabilities that extend platform functionality and market coverage. Each acquisition serves the larger platformization vision, creating synergies that exceed the sum of individual parts.

This approach contrasts sharply with competitors who acquire for scale or geographic expansion. Palo Alto Networks acquires for strategic depth, building capabilities that reinforce competitive moats rather than simply expanding market presence.

The cybersecurity industry’s evolution toward platform unity, data transparency, and strategic partnerships defines success in 2025. Palo Alto Networks isn’t just riding this trend—they’re creating it.

Enterprise customers increasingly prefer comprehensive platforms over point solutions for several compelling reasons: simplified vendor management, integrated threat intelligence, unified security policies, and reduced operational complexity. This consolidation trend strongly favors established platforms with broad capability sets and proven integration expertise.

In cybersecurity, brand reputation transcends traditional marketing metrics. When organizations experience security incidents, they need partners they can trust completely. Palo Alto Networks has built a brand synonymous with enterprise-grade security and reliability—intangible assets that command premium pricing and customer loyalty.

The company’s thought leadership in emerging areas like AI security and zero-trust architecture positions it as not just a vendor but a strategic advisor. This consultative relationship creates deeper customer engagement and higher switching costs than transactional vendor relationships.

For fiscal 2024, the company forecasted billings growth of 10% to 11%, revenue growth of 16%, and an impressive adjusted EPS increase of 25% to 26%. These numbers tell a story of operational leverage and platform scaling effects.

The revenue growth profile reflects successful platform expansion rather than simple market share capture. As customers adopt additional platform components, average contract values increase while marginal customer acquisition costs decrease. This dynamic creates accelerating returns to scale that pure-play security vendors cannot replicate.

The company’s margin expansion demonstrates genuine pricing power derived from platform switching costs and integrated value proposition. Unlike commodity software providers competing on price, Palo Alto Networks competes on comprehensive capabilities and operational integration—factors that justify premium pricing.

Strong cash flow generation enables the company to fund platform expansion and strategic acquisitions without diluting shareholders or constraining growth investments. This financial independence provides strategic flexibility that debt-burdened or cash-constrained competitors lack.

The cash generation profile also supports consistent R&D investment and aggressive market expansion without compromising profitability or shareholder returns. This balance of growth investment and profitability indicates mature management execution and sustainable business model dynamics.

For Palo Alto Networks to triple in value over the next decade, several strategic elements must align perfectly:

The platform consolidation trend must accelerate, with enterprises increasingly preferring comprehensive security ecosystems over point solutions. Early evidence suggests this trend is strengthening as organizations prioritize operational efficiency and integrated threat response capabilities.

AI integration must deliver measurable security improvements that justify premium pricing while creating competitive differentiation. The company’s early AI implementation across platform components positions it advantageously, but execution quality will determine whether this advantage expands or erodes.

The path to $15 billion ARR by 2030 requires consistent platform expansion and customer wallet share capture. Success demands not just retaining existing customers but systematically expanding their platform adoption and contract values.

The counter-narrative focuses on several strategic vulnerabilities:

Cloud-native security startups might develop fundamentally superior architectures that make current platform approaches obsolete. While Palo Alto Networks has cloud capabilities, innovative competitors might create solutions that are native to cloud environments from inception rather than adapted to them.

Large technology platforms like Microsoft, Amazon, or Google might bundle security capabilities into their core offerings at marginal pricing. This “good enough” security approach could commoditize portions of Palo Alto Networks’ value proposition, particularly for cost-sensitive market segments.

Regulatory changes might fragment the cybersecurity market in ways that favor specialized solutions over integrated platforms. Compliance requirements could create market segments where platform breadth becomes less valuable than specialized depth.

Economic downturns might pressure enterprises to prioritize cost reduction over platform consolidation, potentially slowing the secular shift toward comprehensive security ecosystems that drives the company’s growth thesis.

The qualitative investment thesis for Palo Alto Networks rests on three interconnected pillars: visionary leadership executing a platform strategy, structural competitive advantages that strengthen over time, and market positioning in a secular growth industry where the company helps define future competitive dynamics.

Nikesh Arora’s leadership combines strategic vision with operational excellence, creating a management team capable of navigating complex market transitions while building sustainable competitive advantages. The platformization strategy isn’t just a business model—it’s an architectural approach that creates expanding economic moats through network effects, switching costs, and operational dependencies.

The cybersecurity market’s evolution toward consolidation and platform solutions strongly favors established players with comprehensive capabilities and proven integration expertise. Palo Alto Networks isn’t just participating in this trend—it’s leading the transformation while building defensive moats that protect market position and pricing power.

The central question for long-term investors: Will platform economics and AI integration create an unassailable competitive position, or will architectural disruption and platform competition erode current advantages?

The qualitative evidence suggests platform advantages are strengthening while competitive threats remain manageable. Leadership quality, strategic positioning, and execution capabilities indicate this company is building something more durable than typical technology investments—a defensible platform empire in an indispensable market.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Past performance does not guarantee future results. Please consult with qualified financial professionals before making investment decisions. Cybersecurity investments carry inherent risks related to technology disruption, competitive pressure, and market volatility.

Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

AppLovin posted record Q2 2025 results, with 77% revenue growth, higher margins, and a strategic shift toward core adtech platforms.

Discover how the Big Beautiful Bill reshapes taxes, healthcare, and national spending in 2025. Explore its impacts on personal finances, federal debt, and everyday life in this comprehensive analysis.

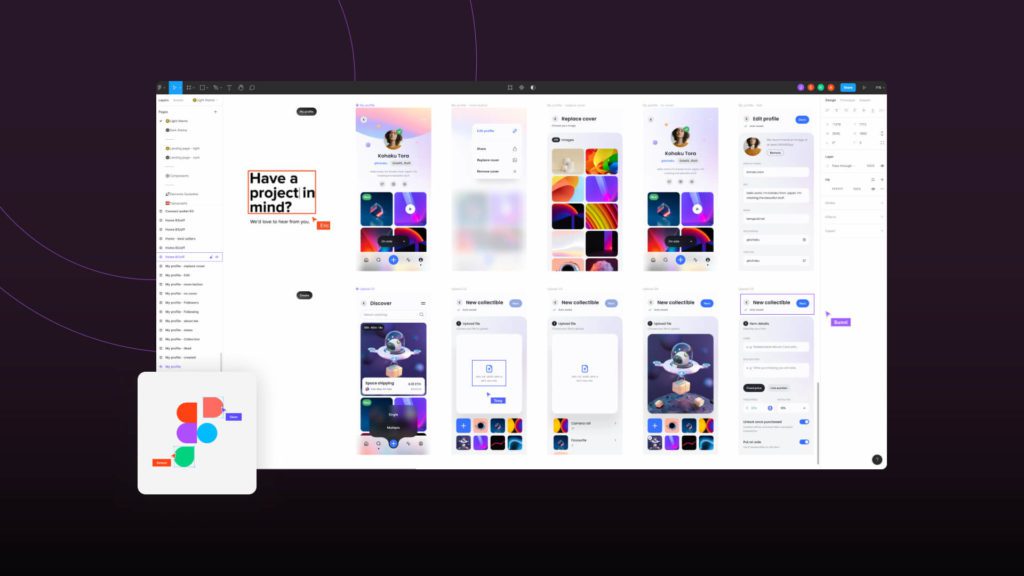

Figma’s S-1 filing reveals a company in hyper-growth, with revenue reaching $700 million, gearing up to IPO on the NYSE.