Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

AppLovin posted record Q2 2025 results, with 77% revenue growth, higher margins, and a strategic shift toward core adtech platforms.

AppLovin’s latest quarterly results confirm the company’s transformation from a mobile app publisher into one of the leading platform players in the adtech industry. The company’s Q2 2025 was characterized by record financials, successful streamlining, technical advances, and an evolving mix of growth drivers.

The quarter saw continued bullishness from industry analysts, with firms such as BTIG raising price targets before results and describing AppLovin as a “Top Pick” for operational leverage and platform leadership. Despite after-hours volatility, the stock responded positively over the longer term as Wall Street digested the strong EPS beat and margin progression.

AppLovin has decisively moved into “platform only” status, competing directly with the likes of Unity and other adtech heavyweights. Management and analysts noted the advertising sector’s increasing emphasis on AI-powered optimization and self-service onboarding, with AppLovin well-positioned to capitalize on both trends. Its battle with Unity—evident in day-of-earnings market moves—highlights growing expectations for best-in-class monetization, developer tools, and ad innovation across the digital advertising sector.

CEO Harris K. attributed the strong results to the effectiveness of AppLovin’s marketing platform and a commitment to innovation. CFO David Hsiao highlighted the company’s ability to scale efficiently while maintaining strong margins. The VP of Marketing emphasized that “strategic initiatives yielded positive results” and noted the company’s readiness to capitalize further on market trends.

Looking to Q3 2025:

AppLovin’s Q2 2025 is a testament to its agility and technical prowess. By refocusing on its core adtech platform, accelerating R&D in AI-driven optimization, and maintaining industry-leading margins, AppLovin is now the prototypical “platform-first” player for the next era of advertising technology. The company’s roadmap, retained earnings power, and leadership voice all suggest it will be a central figure as the digital marketing landscape further evolves.

Summary of Key Metrics:

| Metric | Q2 2025 | Q2 2024 | % Change |

|---|---|---|---|

| Revenue | $1,259 million | $711 million | +77% |

| Net Income | $820 million | $310 million | +164% |

| Adjusted EBITDA | $1,018 million | $511 million | +99% |

| Adjusted Gross Margin | 81% | 72% | +900 bps |

| EPS | $2.39 | $0.89 | +168% |

| Free Cash Flow | $768 million | $444 million | +73% |

| Cash & Equivalents | $1,192 million | $697 million | +159% |

AppLovin’s Q2 2025 was one of robust execution, technological evolution, and strategic clarity—setting the stage for sustained leadership in the next chapter of adtech.

Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

Discover how the Big Beautiful Bill reshapes taxes, healthcare, and national spending in 2025. Explore its impacts on personal finances, federal debt, and everyday life in this comprehensive analysis.

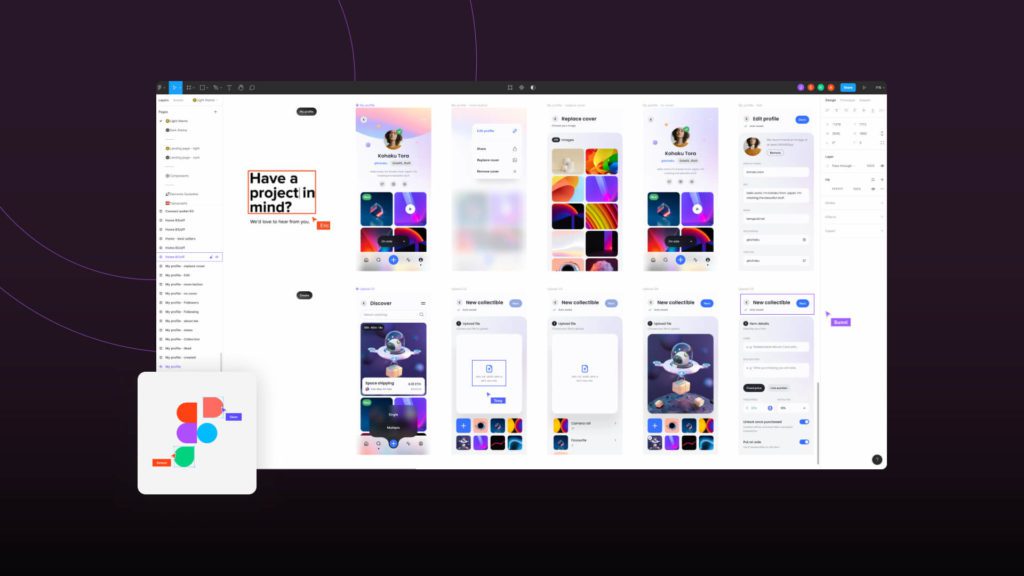

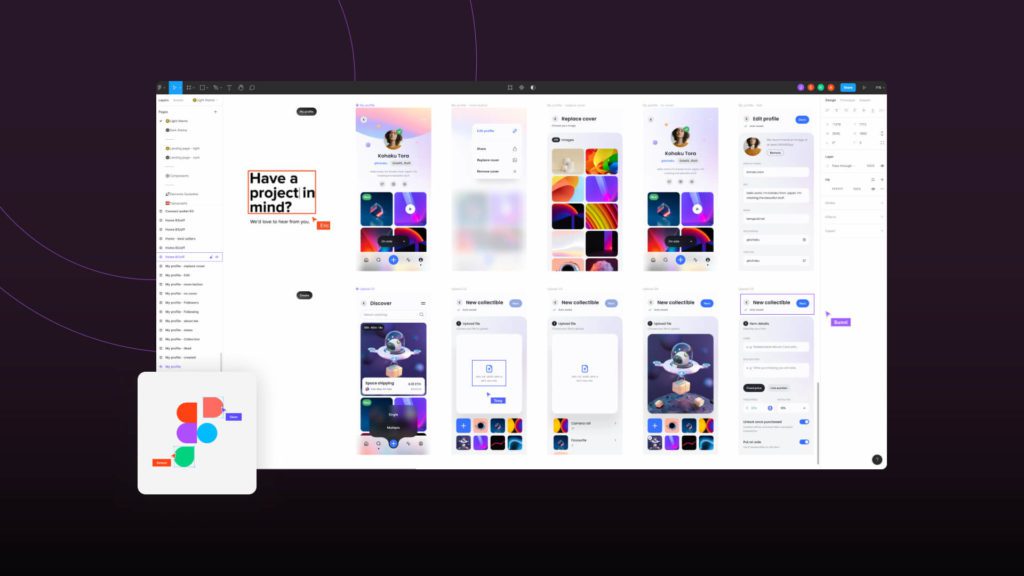

Figma’s S-1 filing reveals a company in hyper-growth, with revenue reaching $700 million, gearing up to IPO on the NYSE.

AppLovin posted record Q2 2025 results, with 77% revenue growth, higher margins, and a strategic shift toward core adtech platforms.

AppLovin’s latest quarterly results confirm the company’s transformation from a mobile app publisher into one of the leading platform players in the adtech industry. The company’s Q2 2025 was characterized by record financials, successful streamlining, technical advances, and an evolving mix of growth drivers.

The quarter saw continued bullishness from industry analysts, with firms such as BTIG raising price targets before results and describing AppLovin as a “Top Pick” for operational leverage and platform leadership. Despite after-hours volatility, the stock responded positively over the longer term as Wall Street digested the strong EPS beat and margin progression.

AppLovin has decisively moved into “platform only” status, competing directly with the likes of Unity and other adtech heavyweights. Management and analysts noted the advertising sector’s increasing emphasis on AI-powered optimization and self-service onboarding, with AppLovin well-positioned to capitalize on both trends. Its battle with Unity—evident in day-of-earnings market moves—highlights growing expectations for best-in-class monetization, developer tools, and ad innovation across the digital advertising sector.

CEO Harris K. attributed the strong results to the effectiveness of AppLovin’s marketing platform and a commitment to innovation. CFO David Hsiao highlighted the company’s ability to scale efficiently while maintaining strong margins. The VP of Marketing emphasized that “strategic initiatives yielded positive results” and noted the company’s readiness to capitalize further on market trends.

Looking to Q3 2025:

AppLovin’s Q2 2025 is a testament to its agility and technical prowess. By refocusing on its core adtech platform, accelerating R&D in AI-driven optimization, and maintaining industry-leading margins, AppLovin is now the prototypical “platform-first” player for the next era of advertising technology. The company’s roadmap, retained earnings power, and leadership voice all suggest it will be a central figure as the digital marketing landscape further evolves.

Summary of Key Metrics:

| Metric | Q2 2025 | Q2 2024 | % Change |

|---|---|---|---|

| Revenue | $1,259 million | $711 million | +77% |

| Net Income | $820 million | $310 million | +164% |

| Adjusted EBITDA | $1,018 million | $511 million | +99% |

| Adjusted Gross Margin | 81% | 72% | +900 bps |

| EPS | $2.39 | $0.89 | +168% |

| Free Cash Flow | $768 million | $444 million | +73% |

| Cash & Equivalents | $1,192 million | $697 million | +159% |

AppLovin’s Q2 2025 was one of robust execution, technological evolution, and strategic clarity—setting the stage for sustained leadership in the next chapter of adtech.

Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

Discover how the Big Beautiful Bill reshapes taxes, healthcare, and national spending in 2025. Explore its impacts on personal finances, federal debt, and everyday life in this comprehensive analysis.

Figma’s S-1 filing reveals a company in hyper-growth, with revenue reaching $700 million, gearing up to IPO on the NYSE.

AST Spacemobile’s newest ASIC chip promises 10X the network capacity, 120 Mbps speeds — check out what it means for the company!