Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

Figma’s S-1 filing reveals a company in hyper-growth, with revenue reaching $700 million, gearing up to IPO on the NYSE.

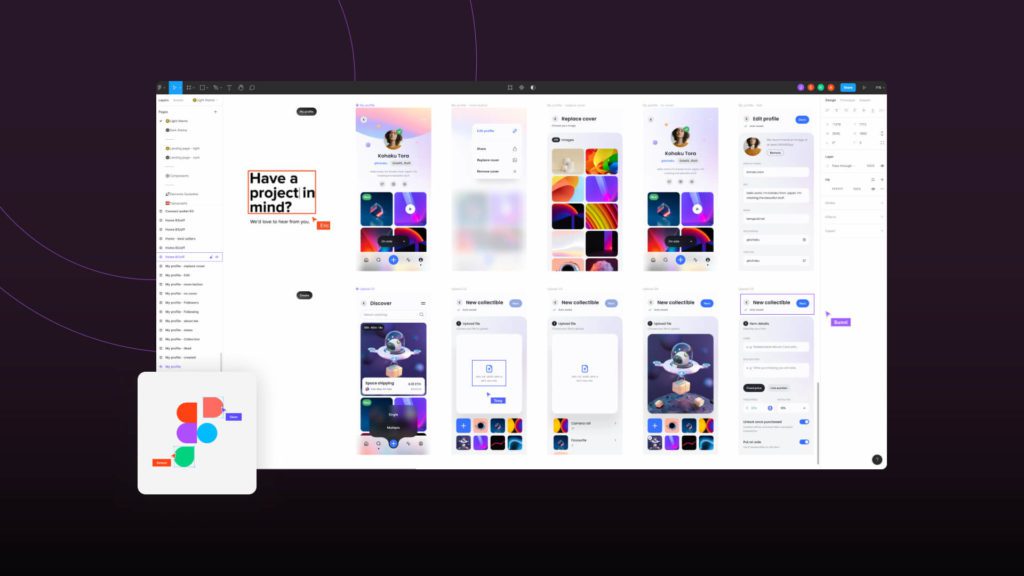

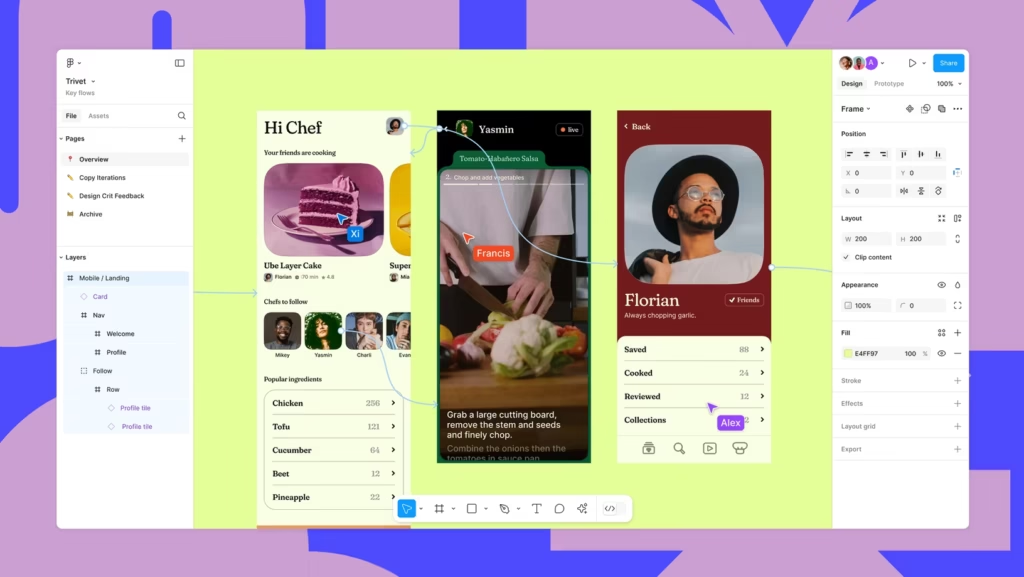

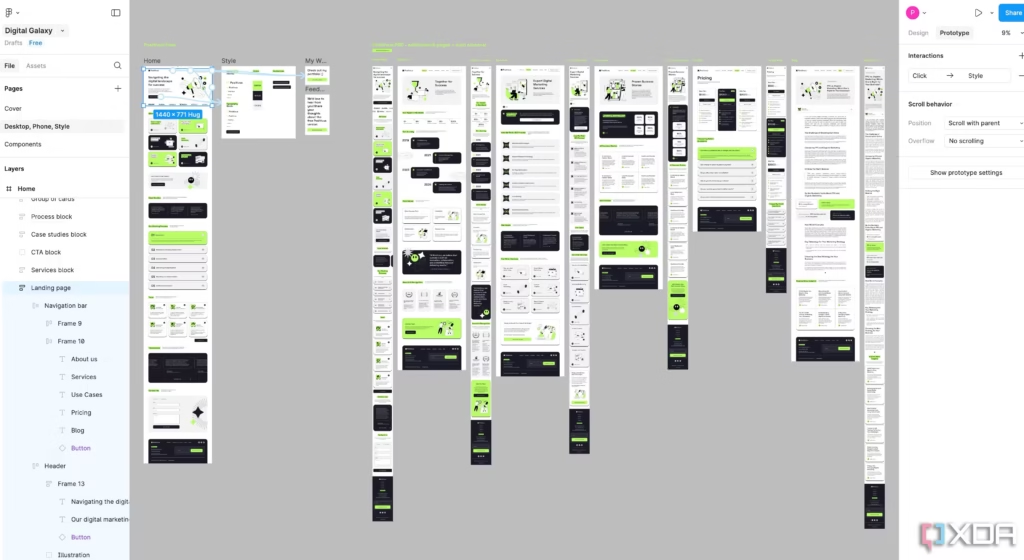

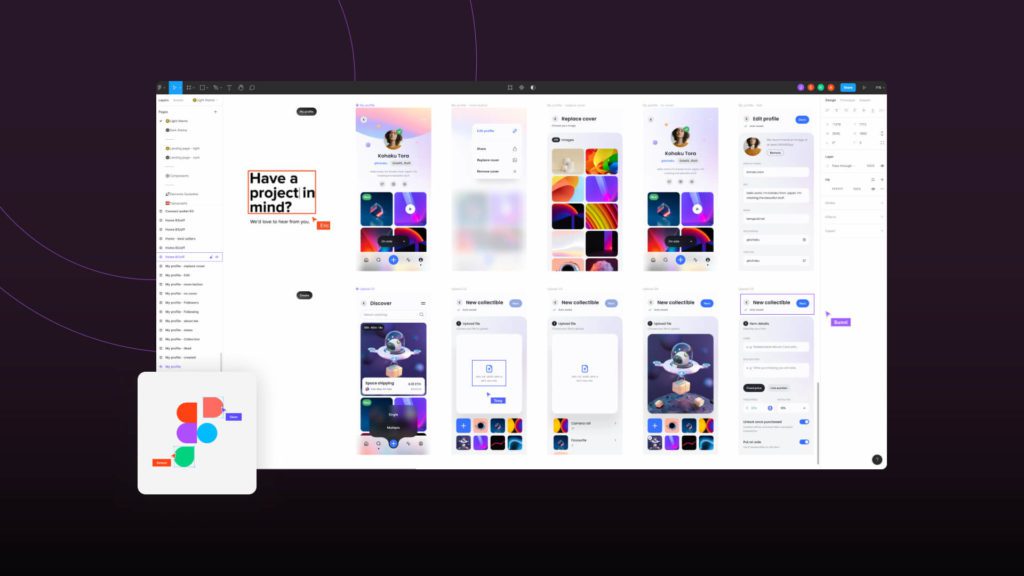

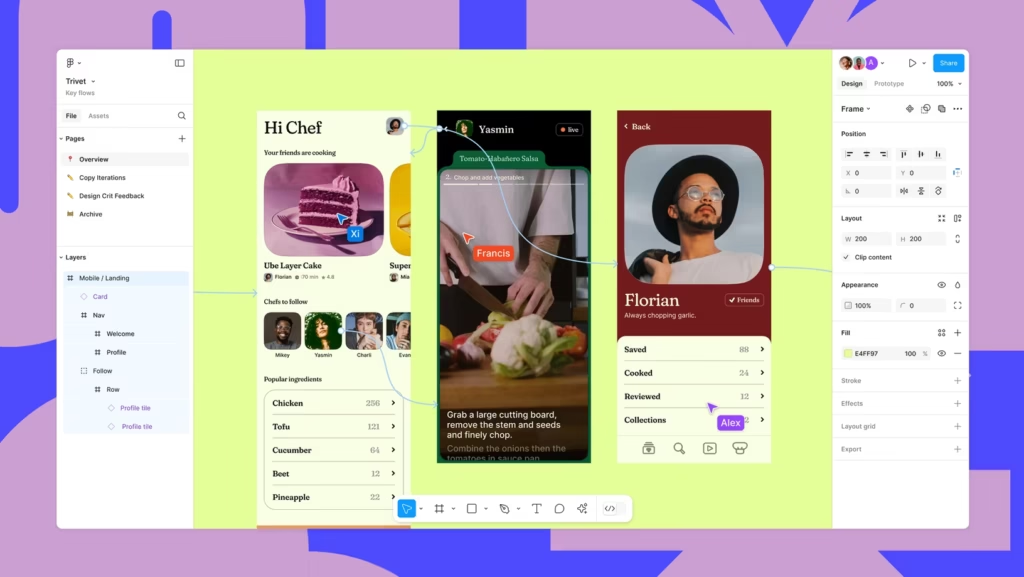

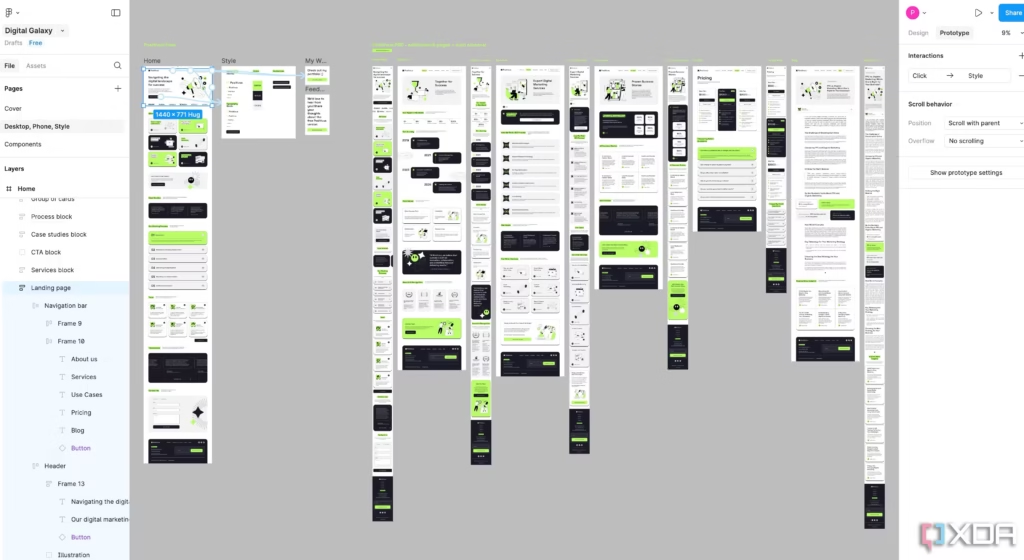

Figma, Inc., a company that has significantly influenced the digital design software industry with its web-based, collaborative platform, has formally filed a Form S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for an Initial Public Offering (IPO). The document, made public on July 1, 2025, provides the first comprehensive financial and operational disclosure for the prominent technology firm. This analysis examines the key components of the filing, including the company’s financial performance, business model, competitive positioning, and the strategic implications of its forthcoming debut on the New York Stock Exchange under the ticker symbol “FIG.”

Founded in 2012 by Dylan Field and Evan Wallace, Figma was established with the objective of making design a more accessible, collaborative, and web-native process. The company’s platform has since become an integral component of the product development lifecycle for a wide range of professionals, including designers, engineers, and product managers, at organizations globally.

Figma’s go-to-market strategy is a notable example of product-led growth (PLG). This model is predicated on a freemium offering that allows individuals and small teams to utilize the core product functionalities without charge, thereby facilitating widespread, viral adoption within organizations. As user teams expand and require more sophisticated features—such as centralized design systems, enhanced security protocols, and administrative oversight—they are incentivized to convert to paid subscription tiers.

The company’s product portfolio comprises an integrated suite of tools:

The S-1 filing depicts a company in a state of hyper-growth, characterized by a strategic prioritization of market share acquisition and product innovation over near-term profitability.

Figma has demonstrated exceptional revenue growth, a key performance indicator for high-growth SaaS companies. The filing details a significant and sustained acceleration in revenue over the preceding three fiscal years.

These figures represent a year-over-year growth rate of 90% from fiscal 2022 to 2023, followed by a 75% increase from fiscal 2023 to 2024. This growth is attributable to both new customer acquisition and strong net dollar retention, which is a measure of revenue growth from existing customers. It is anticipated that Figma’s net dollar retention rate will exceed 130%, indicating significant expansion within its current customer base.

Despite its impressive revenue trajectory, Figma is not yet profitable on a Generally Accepted Accounting Principles (GAAP) basis, a reflection of its substantial and deliberate reinvestment into the business.

A gross margin of 89% is exceptionally high, even within the software industry, and underscores the strong underlying economics of the business. The net loss is a direct consequence of significant operating expenditures, primarily in two key areas:

Statement of Operations (for the fiscal year ended January 31, 2025):

| Metric | Amount |

|---|---|

| Total Revenue | $700 million |

| Cost of Revenue | $77 million |

| Gross Profit | $623 million |

| Operating Expenses: | |

| Research and Development | $250 million |

| Sales and Marketing | $300 million |

| General and Administrative | $123 million |

| Total Operating Expenses | $673 million |

| Operating Loss | ($50 million) |

| Other Income (Expense), Net | ($5 million) |

| Net Loss Before Taxes | ($55 million) |

| Provision for Income Taxes | $5 million |

| Net Loss | ($50 million) |

Balance Sheet (as of January 31, 2025):

| Assets | Liabilities & Stockholders’ Equity |

|---|---|

| Cash and Cash Equivalents: $1.2 billion | Total Liabilities: $400 million |

| Total Assets: $2.5 billion | Total Stockholders’ Equity: $2.1 billion |

The company’s balance sheet is strong, with a substantial cash position that provides considerable operational flexibility. The proceeds from the IPO are expected to further strengthen this financial position.

Figma has established a dominant position within the product design software market.

The S-1 filing outlines the terms of the offering, including a capital structure designed to maintain founder control.

The S-1 filing identifies several key risk factors for prospective investors, including:

Figma’s S-1 filing presents a compelling narrative of a category-defining company with a disruptive product, a potent business model, and a substantial market opportunity. Having secured a loyal following within the design community, the company is now poised to present its case to public market investors. The central consideration for investors will be to weigh the company’s premium valuation and lack of profitability against its exceptional growth trajectory and dominant market position. The Figma IPO is set to be a significant event, serving as a key barometer for investor appetite for high-growth technology equities.

Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

AppLovin posted record Q2 2025 results, with 77% revenue growth, higher margins, and a strategic shift toward core adtech platforms.

Discover how the Big Beautiful Bill reshapes taxes, healthcare, and national spending in 2025. Explore its impacts on personal finances, federal debt, and everyday life in this comprehensive analysis.

Figma’s S-1 filing reveals a company in hyper-growth, with revenue reaching $700 million, gearing up to IPO on the NYSE.

Figma, Inc., a company that has significantly influenced the digital design software industry with its web-based, collaborative platform, has formally filed a Form S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for an Initial Public Offering (IPO). The document, made public on July 1, 2025, provides the first comprehensive financial and operational disclosure for the prominent technology firm. This analysis examines the key components of the filing, including the company’s financial performance, business model, competitive positioning, and the strategic implications of its forthcoming debut on the New York Stock Exchange under the ticker symbol “FIG.”

Founded in 2012 by Dylan Field and Evan Wallace, Figma was established with the objective of making design a more accessible, collaborative, and web-native process. The company’s platform has since become an integral component of the product development lifecycle for a wide range of professionals, including designers, engineers, and product managers, at organizations globally.

Figma’s go-to-market strategy is a notable example of product-led growth (PLG). This model is predicated on a freemium offering that allows individuals and small teams to utilize the core product functionalities without charge, thereby facilitating widespread, viral adoption within organizations. As user teams expand and require more sophisticated features—such as centralized design systems, enhanced security protocols, and administrative oversight—they are incentivized to convert to paid subscription tiers.

The company’s product portfolio comprises an integrated suite of tools:

The S-1 filing depicts a company in a state of hyper-growth, characterized by a strategic prioritization of market share acquisition and product innovation over near-term profitability.

Figma has demonstrated exceptional revenue growth, a key performance indicator for high-growth SaaS companies. The filing details a significant and sustained acceleration in revenue over the preceding three fiscal years.

These figures represent a year-over-year growth rate of 90% from fiscal 2022 to 2023, followed by a 75% increase from fiscal 2023 to 2024. This growth is attributable to both new customer acquisition and strong net dollar retention, which is a measure of revenue growth from existing customers. It is anticipated that Figma’s net dollar retention rate will exceed 130%, indicating significant expansion within its current customer base.

Despite its impressive revenue trajectory, Figma is not yet profitable on a Generally Accepted Accounting Principles (GAAP) basis, a reflection of its substantial and deliberate reinvestment into the business.

A gross margin of 89% is exceptionally high, even within the software industry, and underscores the strong underlying economics of the business. The net loss is a direct consequence of significant operating expenditures, primarily in two key areas:

Statement of Operations (for the fiscal year ended January 31, 2025):

| Metric | Amount |

|---|---|

| Total Revenue | $700 million |

| Cost of Revenue | $77 million |

| Gross Profit | $623 million |

| Operating Expenses: | |

| Research and Development | $250 million |

| Sales and Marketing | $300 million |

| General and Administrative | $123 million |

| Total Operating Expenses | $673 million |

| Operating Loss | ($50 million) |

| Other Income (Expense), Net | ($5 million) |

| Net Loss Before Taxes | ($55 million) |

| Provision for Income Taxes | $5 million |

| Net Loss | ($50 million) |

Balance Sheet (as of January 31, 2025):

| Assets | Liabilities & Stockholders’ Equity |

|---|---|

| Cash and Cash Equivalents: $1.2 billion | Total Liabilities: $400 million |

| Total Assets: $2.5 billion | Total Stockholders’ Equity: $2.1 billion |

The company’s balance sheet is strong, with a substantial cash position that provides considerable operational flexibility. The proceeds from the IPO are expected to further strengthen this financial position.

Figma has established a dominant position within the product design software market.

The S-1 filing outlines the terms of the offering, including a capital structure designed to maintain founder control.

The S-1 filing identifies several key risk factors for prospective investors, including:

Figma’s S-1 filing presents a compelling narrative of a category-defining company with a disruptive product, a potent business model, and a substantial market opportunity. Having secured a loyal following within the design community, the company is now poised to present its case to public market investors. The central consideration for investors will be to weigh the company’s premium valuation and lack of profitability against its exceptional growth trajectory and dominant market position. The Figma IPO is set to be a significant event, serving as a key barometer for investor appetite for high-growth technology equities.

Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

AppLovin posted record Q2 2025 results, with 77% revenue growth, higher margins, and a strategic shift toward core adtech platforms.

Discover how the Big Beautiful Bill reshapes taxes, healthcare, and national spending in 2025. Explore its impacts on personal finances, federal debt, and everyday life in this comprehensive analysis.

AST Spacemobile’s newest ASIC chip promises 10X the network capacity, 120 Mbps speeds — check out what it means for the company!