Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

Discover how the Big Beautiful Bill reshapes taxes, healthcare, and national spending in 2025. Explore its impacts on personal finances, federal debt, and everyday life in this comprehensive analysis.

The One Big Beautiful Bill Act (H.R. 1) passed in 2025 represents a landmark piece of legislation under President Trump’s administration. Spanning 870 pages, the bill makes sweeping reforms that affect federal tax systems, spending policies, healthcare, infrastructure, and immigration, among other areas. Below is a detailed breakdown of the bill, its provisions, and its impacts.

The One Big Beautiful Bill Act is touted as an ambitious effort to reshape America’s domestic policies in line with the current administration’s priorities. It is intended to address economic growth through significant tax cuts, bolster border security, and reduce the role of federal oversight. Critics, however, warn of potential negative consequences for healthcare access, public services, and the national debt.

This legislation builds on past reforms like the 2017 Tax Cuts and Jobs Act (TCJA), solidifying many prior tax reductions while expanding them. In addition, the bill introduces major changes to Medicaid, incentivizes defense spending, and reallocates resources for energy production and agricultural programs .

The overall U.S. national debt surpasses $34 trillion, and the Big Beautiful Bill is projected to widen annual deficits significantly. Advocates argue that economic growth spurred by tax reductions will pay for the short-term increases in debt, but independent analyses have raised concerns about the long-term sustainability of these measures .

The One Big Beautiful Bill Act promises to reshape America’s economic and social policies. While its proponents highlight its focus on tax relief, national security, and freedom for states, critics question its impacts on federal revenues, healthcare access, and the rising federal debt. Balancing these priorities will shape the economic and social trajectory of the nation for years to come.

Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

AppLovin posted record Q2 2025 results, with 77% revenue growth, higher margins, and a strategic shift toward core adtech platforms.

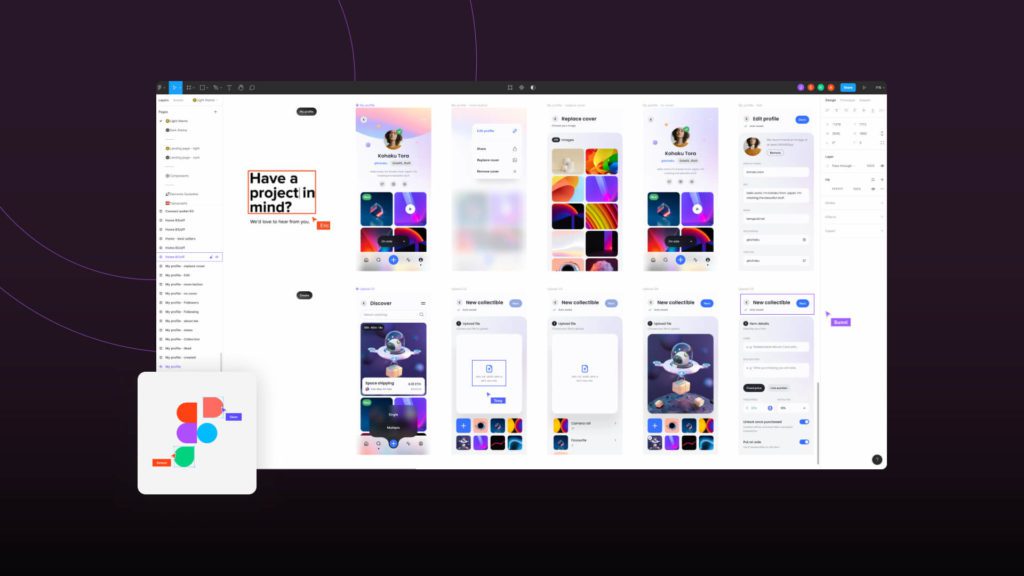

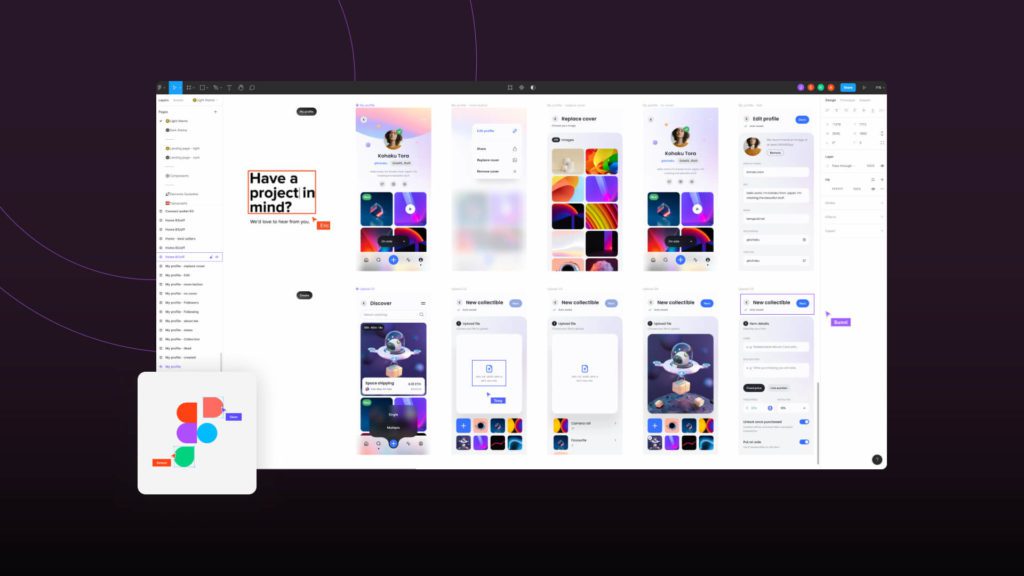

Figma’s S-1 filing reveals a company in hyper-growth, with revenue reaching $700 million, gearing up to IPO on the NYSE.

Discover how the Big Beautiful Bill reshapes taxes, healthcare, and national spending in 2025. Explore its impacts on personal finances, federal debt, and everyday life in this comprehensive analysis.

The One Big Beautiful Bill Act (H.R. 1) passed in 2025 represents a landmark piece of legislation under President Trump’s administration. Spanning 870 pages, the bill makes sweeping reforms that affect federal tax systems, spending policies, healthcare, infrastructure, and immigration, among other areas. Below is a detailed breakdown of the bill, its provisions, and its impacts.

The One Big Beautiful Bill Act is touted as an ambitious effort to reshape America’s domestic policies in line with the current administration’s priorities. It is intended to address economic growth through significant tax cuts, bolster border security, and reduce the role of federal oversight. Critics, however, warn of potential negative consequences for healthcare access, public services, and the national debt.

This legislation builds on past reforms like the 2017 Tax Cuts and Jobs Act (TCJA), solidifying many prior tax reductions while expanding them. In addition, the bill introduces major changes to Medicaid, incentivizes defense spending, and reallocates resources for energy production and agricultural programs .

The overall U.S. national debt surpasses $34 trillion, and the Big Beautiful Bill is projected to widen annual deficits significantly. Advocates argue that economic growth spurred by tax reductions will pay for the short-term increases in debt, but independent analyses have raised concerns about the long-term sustainability of these measures .

The One Big Beautiful Bill Act promises to reshape America’s economic and social policies. While its proponents highlight its focus on tax relief, national security, and freedom for states, critics question its impacts on federal revenues, healthcare access, and the rising federal debt. Balancing these priorities will shape the economic and social trajectory of the nation for years to come.

Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

AppLovin posted record Q2 2025 results, with 77% revenue growth, higher margins, and a strategic shift toward core adtech platforms.

Figma’s S-1 filing reveals a company in hyper-growth, with revenue reaching $700 million, gearing up to IPO on the NYSE.

AST Spacemobile’s newest ASIC chip promises 10X the network capacity, 120 Mbps speeds — check out what it means for the company!