Discover how Palo Alto Networks creates lasting value through platform strategy, AI innovation, and competitive moats in cybersecurity.

Wall Street panics over AI titans like Broadcom despite record earnings. This article reveals why their fear is your signal for a generational wealth opportunity.

In a market move that left many observers bewildered, semiconductor and software behemoth Broadcom saw its stock dip 5% following a blockbuster earnings report. The report was, by all objective measures, a resounding success, showcasing explosive growth fueled by the insatiable demand for artificial intelligence infrastructure. This seemingly paradoxical reaction—strong results met with a stock slump—is not an isolated incident. It is a telling symptom of a market grappling with a technology revolution so vast and rapid that it defies traditional valuation and expectation. While short-term traders may flinch at this volatility, it reveals a profound truth: the AI boom is real, it is accelerating, and the market’s momentary jitters are creating what may be the defining investment opportunity of this generation.

The numbers from Broadcom’s second-quarter fiscal 2025 report were unequivocal. The company posted a significant beat on both earnings per share and revenue, with its AI segment stealing the spotlight. AI revenue surged an astonishing 46% year-over-year to $4.4 billion. CEO Hock Tan added fuel to the fire, forecasting that AI revenue would rocket to $5.1 billion in the third quarter, marking a 60% year-over-year climb.

So, why the slide? The answer lies in the rarified air of investor expectations. In the super-charged AI sector, merely beating estimates is no longer enough; the market demands a colossal beat and an eye-watering forecast to sustain upward momentum. Anything less can trigger a wave of profit-taking from investors who have already enjoyed a spectacular run-up. This dynamic, however, obscures the fundamental strength not just of Broadcom, but of the entire ecosystem powering the AI revolution. Examining the recent performance of other key market movers reveals a consistent, powerful narrative of growth that nervous sellers are missing.

To understand the AI market, one cannot look at a single company in isolation. It is a complex, interconnected ecosystem—a symphony of innovation where chip designers, server manufacturers, and cloud titans all play a critical part. Their collective earnings reports, when viewed together, compose a clear and powerful opus of secular growth.

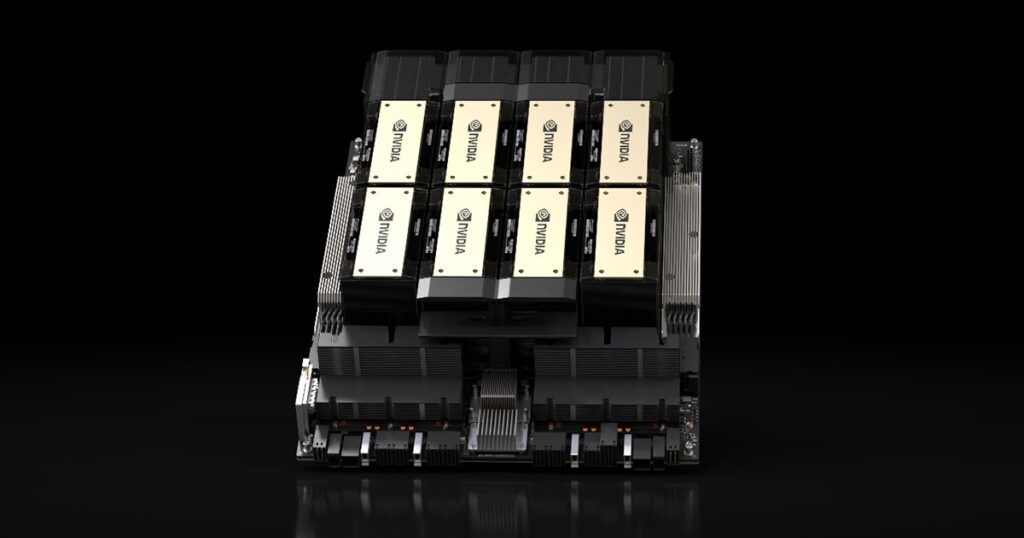

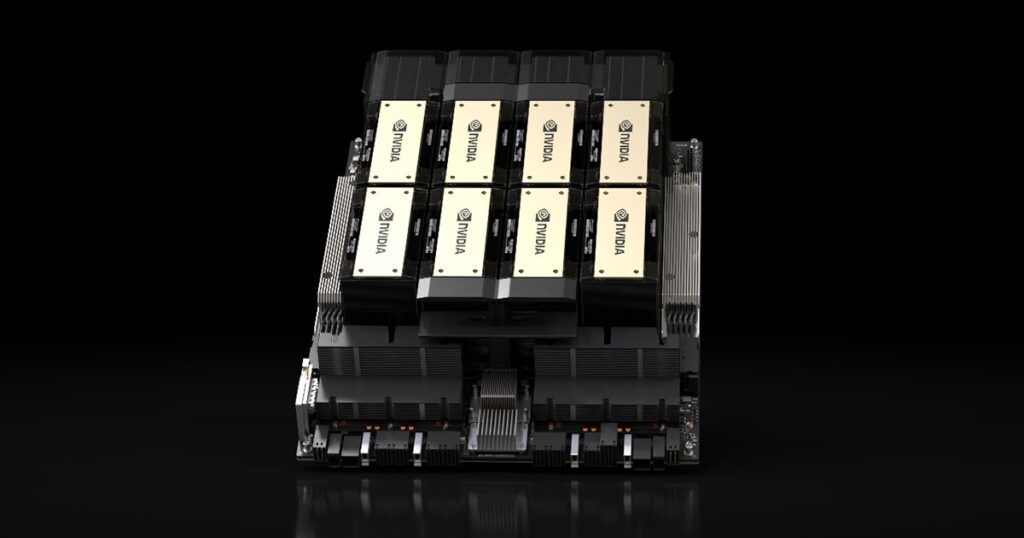

At the heart of this symphony stands Nvidia, the undisputed conductor of the AI orchestra. The company’s recent first-quarter fiscal 2026 earnings report was nothing short of breathtaking. Nvidia announced revenue of $44.1 billion, a 69% increase from the previous year, with its Data Center division—the engine of its AI growth—contributing a staggering $39.1 billion. This wasn’t just growth; it was an acceleration of an already exponential trend.

CEO Jensen Huang announced that the company’s next-generation Blackwell platform, a supercomputer in a chip designed for trillion-parameter AI models, was in full production and being adopted by every major cloud provider and server maker. Even after accounting for the loss of business in China due to export controls, Nvidia guided for second-quarter revenue of $45 billion.

Nvidia’s performance is the ultimate demand signal. The world’s largest and most influential technology companies are lining up to buy tens of billions of dollars’ worth of its hardware. This isn’t speculative spending; it’s a foundational investment in the future of computing, and it validates the entire thesis that AI is a transformative, long-term trend.

If Nvidia provides the engine, companies like Dell Technologies and Super Micro Computer build the high-performance vehicles. Their recent earnings reports provide tangible proof of where Nvidia’s chips are going: into a tsunami of AI-optimized servers.

Dell’s recent quarter was a testament to this boom. The company reported record first-quarter servers and networking revenue of $6.3 billion. More tellingly, COO Jeff Clarke revealed that Dell had received a jaw-dropping $12.1 billion in orders for its AI-optimized servers in the quarter alone, creating a backlog of $14.4 billion. This isn’t just a forecast; it’s a mountain of concrete orders waiting to be fulfilled, showcasing a direct pipeline of demand from enterprises rushing to build out their on-premise AI capabilities.

Similarly, Super Micro Computer has been a primary beneficiary of the AI gold rush, specializing in the high-performance, liquid-cooled server architectures that massive AI clusters require. Its rapid growth has mirrored the trajectory of the AI boom, solidifying its position as a critical enabler. The success of these server makers demonstrates that the demand for AI infrastructure is broad and deep, extending far beyond the handful of hyperscale cloud providers.

The biggest customers for AI hardware are, without question, the cloud titans: Microsoft, Google, and Amazon. Their massive capital expenditures are what fuel the revenues of Nvidia and Broadcom. Recent earnings from this cohort show an unprecedented arms race to build out AI data centers.

Microsoft’s Azure cloud business grew 33% in its latest quarter, with the company explicitly stating that 16 percentage points of that growth came directly from its AI services. The company is spending billions each quarter on data centers, a direct investment in the chips and networking gear that power its popular GitHub Copilot and other AI offerings.

Likewise, Google Cloud saw revenues jump 28%, with executives highlighting intense demand for its AI infrastructure and Vertex AI platform. Parent company Alphabet is pouring capital into servers and data centers to keep pace. Amazon Web Services (AWS), the largest cloud provider, now has an annualized revenue run rate of $117 billion, and CEO Andy Jassy noted that its AI business is already generating billions in revenue and growing at “triple-digit year-over-year percentages.”

This colossal spending from the cloud providers creates a virtuous cycle. They buy chips from Nvidia and networking solutions from Broadcom to build their infrastructure, and in turn, sell AI services to millions of businesses, further embedding AI into the global economy and driving future demand for even more powerful hardware.

When viewed through this wider lens, the 5% dip in Broadcom’s stock appears not as a sign of weakness, but as a sign of the market’s struggle to appropriately price a paradigm shift. The underlying fundamentals across the entire AI hardware and cloud stack are not just strong; they are historically robust and accelerating.

The story of Broadcom is the story of the “picks and shovels” provider in a gold rush. While Nvidia is the premier brand for AI processors (the GPUs), Broadcom is a dominant force in the custom silicon (ASICs) that giants like Google use for their own AI chips, and it is a leader in the high-speed networking components that are essential to connect thousands of those GPUs into a single, cohesive supercomputer. As AI models grow larger, the networking becomes just as critical as the processing. Broadcom is providing the indispensable plumbing for the AI data center of the future.

The selling investors who reacted to the headline stock drop are missing this crucial context. They are focusing on the impossibly high bar of market expectations rather than the undeniable strength of the underlying business.

The current market environment, characterized by pockets of volatility amidst a clear secular boom, is a gift to the patient, long-term investor. The collective earnings reports from Nvidia, Dell, Microsoft, Google, Amazon, AMD, and Broadcom paint an unambiguous picture: we are in the early stages of a multi-trillion-dollar technological transformation.

This is not a fleeting trend. It is a fundamental rewiring of the global economy, on par with the advent of the internet or the mobile phone. For investors with a time horizon measured in years, not days, the strategy is clear. The noise of daily stock price fluctuations should be ignored in favor of the signal from the businesses themselves. That signal is screaming that the demand for AI is real, growing, and will continue to drive unprecedented growth for the companies that form its foundation.

The dip in a high-quality, mission-critical company like Broadcom is not a reason to sell. It is a reason to pay close attention. In the grand scheme of this generational market shift, such moments of short-term doubt will likely be remembered as the ideal moments to have acted with long-term conviction.

Discover how Palo Alto Networks creates lasting value through platform strategy, AI innovation, and competitive moats in cybersecurity.

Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

AppLovin posted record Q2 2025 results, with 77% revenue growth, higher margins, and a strategic shift toward core adtech platforms.

Wall Street panics over AI titans like Broadcom despite record earnings. This article reveals why their fear is your signal for a generational wealth opportunity.

In a market move that left many observers bewildered, semiconductor and software behemoth Broadcom saw its stock dip 5% following a blockbuster earnings report. The report was, by all objective measures, a resounding success, showcasing explosive growth fueled by the insatiable demand for artificial intelligence infrastructure. This seemingly paradoxical reaction—strong results met with a stock slump—is not an isolated incident. It is a telling symptom of a market grappling with a technology revolution so vast and rapid that it defies traditional valuation and expectation. While short-term traders may flinch at this volatility, it reveals a profound truth: the AI boom is real, it is accelerating, and the market’s momentary jitters are creating what may be the defining investment opportunity of this generation.

The numbers from Broadcom’s second-quarter fiscal 2025 report were unequivocal. The company posted a significant beat on both earnings per share and revenue, with its AI segment stealing the spotlight. AI revenue surged an astonishing 46% year-over-year to $4.4 billion. CEO Hock Tan added fuel to the fire, forecasting that AI revenue would rocket to $5.1 billion in the third quarter, marking a 60% year-over-year climb.

So, why the slide? The answer lies in the rarified air of investor expectations. In the super-charged AI sector, merely beating estimates is no longer enough; the market demands a colossal beat and an eye-watering forecast to sustain upward momentum. Anything less can trigger a wave of profit-taking from investors who have already enjoyed a spectacular run-up. This dynamic, however, obscures the fundamental strength not just of Broadcom, but of the entire ecosystem powering the AI revolution. Examining the recent performance of other key market movers reveals a consistent, powerful narrative of growth that nervous sellers are missing.

To understand the AI market, one cannot look at a single company in isolation. It is a complex, interconnected ecosystem—a symphony of innovation where chip designers, server manufacturers, and cloud titans all play a critical part. Their collective earnings reports, when viewed together, compose a clear and powerful opus of secular growth.

At the heart of this symphony stands Nvidia, the undisputed conductor of the AI orchestra. The company’s recent first-quarter fiscal 2026 earnings report was nothing short of breathtaking. Nvidia announced revenue of $44.1 billion, a 69% increase from the previous year, with its Data Center division—the engine of its AI growth—contributing a staggering $39.1 billion. This wasn’t just growth; it was an acceleration of an already exponential trend.

CEO Jensen Huang announced that the company’s next-generation Blackwell platform, a supercomputer in a chip designed for trillion-parameter AI models, was in full production and being adopted by every major cloud provider and server maker. Even after accounting for the loss of business in China due to export controls, Nvidia guided for second-quarter revenue of $45 billion.

Nvidia’s performance is the ultimate demand signal. The world’s largest and most influential technology companies are lining up to buy tens of billions of dollars’ worth of its hardware. This isn’t speculative spending; it’s a foundational investment in the future of computing, and it validates the entire thesis that AI is a transformative, long-term trend.

If Nvidia provides the engine, companies like Dell Technologies and Super Micro Computer build the high-performance vehicles. Their recent earnings reports provide tangible proof of where Nvidia’s chips are going: into a tsunami of AI-optimized servers.

Dell’s recent quarter was a testament to this boom. The company reported record first-quarter servers and networking revenue of $6.3 billion. More tellingly, COO Jeff Clarke revealed that Dell had received a jaw-dropping $12.1 billion in orders for its AI-optimized servers in the quarter alone, creating a backlog of $14.4 billion. This isn’t just a forecast; it’s a mountain of concrete orders waiting to be fulfilled, showcasing a direct pipeline of demand from enterprises rushing to build out their on-premise AI capabilities.

Similarly, Super Micro Computer has been a primary beneficiary of the AI gold rush, specializing in the high-performance, liquid-cooled server architectures that massive AI clusters require. Its rapid growth has mirrored the trajectory of the AI boom, solidifying its position as a critical enabler. The success of these server makers demonstrates that the demand for AI infrastructure is broad and deep, extending far beyond the handful of hyperscale cloud providers.

The biggest customers for AI hardware are, without question, the cloud titans: Microsoft, Google, and Amazon. Their massive capital expenditures are what fuel the revenues of Nvidia and Broadcom. Recent earnings from this cohort show an unprecedented arms race to build out AI data centers.

Microsoft’s Azure cloud business grew 33% in its latest quarter, with the company explicitly stating that 16 percentage points of that growth came directly from its AI services. The company is spending billions each quarter on data centers, a direct investment in the chips and networking gear that power its popular GitHub Copilot and other AI offerings.

Likewise, Google Cloud saw revenues jump 28%, with executives highlighting intense demand for its AI infrastructure and Vertex AI platform. Parent company Alphabet is pouring capital into servers and data centers to keep pace. Amazon Web Services (AWS), the largest cloud provider, now has an annualized revenue run rate of $117 billion, and CEO Andy Jassy noted that its AI business is already generating billions in revenue and growing at “triple-digit year-over-year percentages.”

This colossal spending from the cloud providers creates a virtuous cycle. They buy chips from Nvidia and networking solutions from Broadcom to build their infrastructure, and in turn, sell AI services to millions of businesses, further embedding AI into the global economy and driving future demand for even more powerful hardware.

When viewed through this wider lens, the 5% dip in Broadcom’s stock appears not as a sign of weakness, but as a sign of the market’s struggle to appropriately price a paradigm shift. The underlying fundamentals across the entire AI hardware and cloud stack are not just strong; they are historically robust and accelerating.

The story of Broadcom is the story of the “picks and shovels” provider in a gold rush. While Nvidia is the premier brand for AI processors (the GPUs), Broadcom is a dominant force in the custom silicon (ASICs) that giants like Google use for their own AI chips, and it is a leader in the high-speed networking components that are essential to connect thousands of those GPUs into a single, cohesive supercomputer. As AI models grow larger, the networking becomes just as critical as the processing. Broadcom is providing the indispensable plumbing for the AI data center of the future.

The selling investors who reacted to the headline stock drop are missing this crucial context. They are focusing on the impossibly high bar of market expectations rather than the undeniable strength of the underlying business.

The current market environment, characterized by pockets of volatility amidst a clear secular boom, is a gift to the patient, long-term investor. The collective earnings reports from Nvidia, Dell, Microsoft, Google, Amazon, AMD, and Broadcom paint an unambiguous picture: we are in the early stages of a multi-trillion-dollar technological transformation.

This is not a fleeting trend. It is a fundamental rewiring of the global economy, on par with the advent of the internet or the mobile phone. For investors with a time horizon measured in years, not days, the strategy is clear. The noise of daily stock price fluctuations should be ignored in favor of the signal from the businesses themselves. That signal is screaming that the demand for AI is real, growing, and will continue to drive unprecedented growth for the companies that form its foundation.

The dip in a high-quality, mission-critical company like Broadcom is not a reason to sell. It is a reason to pay close attention. In the grand scheme of this generational market shift, such moments of short-term doubt will likely be remembered as the ideal moments to have acted with long-term conviction.

Discover how Palo Alto Networks creates lasting value through platform strategy, AI innovation, and competitive moats in cybersecurity.

Trump administration takes historic $8.9 billion stake in Intel, acquiring 10% ownership amid bipartisan criticism and concerns over government intervention in private enterprise.

AppLovin posted record Q2 2025 results, with 77% revenue growth, higher margins, and a strategic shift toward core adtech platforms.

Discover how the Big Beautiful Bill reshapes taxes, healthcare, and national spending in 2025. Explore its impacts on personal finances, federal debt, and everyday life in this comprehensive analysis.